1 Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and the HintMD platform exited 2020 with an annualized run rate of over $200 million in payment processing volume. In addition, our successful financing activities throughout the year resulted in a cash, cash equivalent and short-term investment balance of approximately $436.5 million at year-end, which will provide us with sufficient funding into 2024. In summary, our diligence and hard work paid off and we are well positioned to continue advancing our commercial story.

impairment charges.

•Implemented a Clawback Policy. Effective January 1, 2021, we adopted an executive compensation clawback policySecure ~50% commercial coverage by commercial launch for CD, which provides the Board with the authority to recover performance-based cash and equity incentive compensation of current and former executive officers if they engaged in fraud or willful misconduct that was a significant contributing factor to the company having to restate its financial statements.

Focused and Compensation Committee’s thoughtful approachdisciplined capital allocation:

•Remain focused on disciplined capital allocation with ongoing operational efficiencies to human capital management, it is committedsupport path to continuing to improve the company’s executive compensation program based on company needs, market data,break-even and stockholder feedback.Adjusted EBITDA1 in 2025.

In closing, it is an honor to serve as your Chairman, and on behalf of the Board, I thank you for your continued support and investment in Revance. We look forward to your participation at our virtual annual meeting on May 5, 2021.1, 2024.

Very truly yours,

| |||||

Angus C. Russell

Chairman of the Board of Directors

March 24, 2021

21, 2024

REVANCE THERAPEUTICS, INC.

1222 Demonbreun Street, Suite 10012000

Nashville, Tennessee 37203

Notice of Annual Meeting of Stockholders

To Be Held On Wednesday, May 5, 20211, 2024

Dear Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of REVANCE THERAPEUTICS, INC. (the "Company"“Company”), a Delaware corporation. Due to the COVID-19 pandemic, theThe meeting will be held virtually on Wednesday, May 5, 20211, 2024 at 10:00 a.m. Central Time via live audio-only webcast at www.virtualshareholdermeeting.com/RVNC2021RVNC2024. The meeting will be held online only, and you will not be able to attend in person. You will be able to vote your shares electronically by Internet and submit questions online during the meeting by logging in tointo the website listed above using the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials. Online check-in will begin at 9:45 a.m. Central Time and should allow ample time for the check-in procedures.

The Annual Meeting of Stockholders is being convened for the following purposes:

(1)To elect to the Board of Directors' three nominees for director to hold office until the 20242027 Annual Meeting of Stockholders.

(2)To ratify the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the fiscal year 2021.2024.

(3)To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in the Proxy Statement accompanying this Notice.Statement.

(4)To approve an amendment to our Amended and Restated Certificate of Incorporation (our “Charter”) to increase the number of authorized shares of our common stock from 95,000,000 to 190,000,000 shares.

These items of business are more fully described in the Proxy Statement accompanying this Notice. The record date for the Annual Meeting of Stockholders is March 11, 2021.8, 2024. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

to be Held on May 5, 20211, 2024 virtually via live audio-only webcast at

www.virtualshareholdermeeting.com/RVNC2021RVNC2024.

The Notice, Proxy Statement and Annual Report to Stockholders are available at www.proxyvote.com.

By Order of the Board of Directors,

| Mark J. Foley | ||

| Nashville, Tennessee | ||

| March | ||

| You are cordially invited to attend the meeting virtually. Whether or not you expect to attend the meeting virtually via live audio-only webcast, please complete, date, sign and return the proxy card sent to you, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote electronically during the meeting. | ||

REVANCE THERAPEUTICS, INC.

PROXY SUMMARY

This is a summary only, and does not contain all of the information that you should consider in connection with this Proxy Statement. Please read the entire Proxy Statement carefully before voting.

Annual Meeting of the Stockholders

•Date and Time: Wednesday, May 5, 20211, 2024, at 10:00 a.m. Central Time. Online check-in will begin at 9:45 a.m. Central Time, and you should allow ample time for the check-in procedures.

•Location: The meeting will be held virtually via live audio-only webcast at www.virtualshareholdermeeting.com/RVNC2021RVNC2024.

•Admission: To attend the meeting, you will need the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials.

•Record Date: March 11, 2021.8, 2024.

•Proxy Mailing Date: March 24, 2021.21, 2024.

•Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals.

Voting Matters

Stockholders are being asked to vote on the following matters:

| Items of Business | Page | Our Board’s Recommendation | |||||||||||||||

| 1. Election of Directors | FOR all nominees | ||||||||||||||||

| 2. Ratification of the selection of PricewaterhouseCoopers LLP | FOR | ||||||||||||||||

| 3. Approval of, on an advisory basis, the compensation of our | FOR | ||||||||||||||||

Stockholders will also transact any other business that may properly come before the meeting.

How to Vote

You are entitled to vote at our 20212024 Annual Meeting of Stockholders (the "Annual Meeting"“Annual Meeting”) if you were a stockholder of record at the close of business on March 11, 2021,8, 2024, the record date for the meeting. On the record date, there were 71,382,894104,215,614 shares of our common stock outstanding and entitled to vote at the annual meeting.Annual Meeting. For more details on voting and the annual meeting logistics, refer toplease see the “Questions and Answers” section of this proxy statement.Proxy Statement.

All references to “Revance,” “we,” “us,” “our” and “Company” in these proxy materials refer to Revance Therapeutics, Inc.

Aesthetics

•ExecutedInitiated full commercial launch of DAXXIFYin 2023.

•Generated $234.0 million in total revenue, which included $212.7 million in product revenue sales of DAXXIFY and the Teoxane SA ("Teoxane") dermal filler agreement, which allowed us to gain exclusive rights to commercialize a line of hyaluronic acid dermal fillers which have been approved by the FDA for the correction of moderate to severe dynamic facial wrinkles and folds (the "RHA® Collection of dermal fillers") in the United States;

•Introduced new pricing and HintMD platform;

•Delivered positive Phase 2 open-label study resultsIncreased aesthetic accounts to over 7,000 across our Products business, and of DaxibotulinumtoxinAthose accounts, over 3,000 were DAXXIFYaccounts for Injectionthe year ended December 31, 2023.

•Teoxane SA received U.S. Food and Drug Administration (“FDA”) approval for the expansion of RHA® 4’s label to include cannula use in forehead lines, crow's feet,July 2023 and upper facial lines;RHA® 3’s label to include injection into the vermillion body, vermillion border and oral commissure for lip augmentation and lip fullness in adults aged 22 years and older in January 2024.

•Obtained Biologics License ApplicationReceived FDA approval in March 2023 of our post approval supplement (“PAS”) for Ajinomoto Althaea, Inc., doing business as Ajinomoto Bio-Pharma Services (“ABPS”), a contract development and manufacturing organization for the Company, which serves as our primary commercial drug product supply source for DAXXIFY.

•Received China’s National Medical Products Association’s (“NMPA”) acceptance of Shanghai Fosun Pharmaceutical Industrial Development Co., Ltd.’s, a wholly-owned subsidiary of Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (“Fosun”) biologics license application (“BLA”) acceptance and target Prescription Drug User Fee Act (“PDUFA”) date for DaxibotulinumtoxinA for Injection for the treatmentimprovement of glabellar lines althoughand treatment of cervical dystonia in April and July 2023, respectively.

•Exited the U.S. FoodOPUL® Relational Commerce Platform and Drug Administration (the "FDA"HintMD fintech platform (together the “Fintech Platform”) deferred its action onpayment processing business in alignment with the BLA as a result of its inabilityCompany’s capital allocation priorities, with the remaining wind-down activities scheduled to conduct an inspection of our manufacturing facility due to COVID-19 related travel restrictions (the “FDA COVID Delay”).be completed by April 1, 2024.

Therapeutics

•Delivered positive results fromSecured the ASPEN-1 Phase 3 pivotal trialFDA approval in August 2023 of DaxibotulinumtoxinA for InjectionDAXXIFY for the treatment of cervical dystonia; anddystonia in adults in the U.S. (“DAXXIFY CD Approval”).

•Reported Phase 2 results of DaxibotulinumtoxinA for InjectionInitiated DAXXIFY’s early experience program for the managementtreatment of plantar fasciitis.cervical dystonia (“CD PrevU”) in September 2023.

•Achieved stock price appreciationReceived permanent J-Code for DAXXIFY for the treatment of cervical dystonia in 2020, resulting in a total stockholder return ("TSR") of approximately 77%;January 2024.

•Announced the relocation of our headquarters to Nashville, which was effective January 1, 2021;

•Raised net proceeds of $100.0 million after sales agent commissions and offering costs from our at-the-market offering ("ATM"program during the three months ended June 30, 2023.

•Secured gross proceeds of $50.0 million in connection with the issuance of notes payable to Athyrium Capital Management (“Athyrium Capital”) program, for a totalin connection with the First Amendment to the existing Note Purchase

agreement by and among the Company, Hint, Inc. and Athyrium Capital, dated August 8, 2023 (the “NPA Amendment”).

•Ended fiscal year 2023 with cash, cash equivalentequivalents and short-term investment balance at year-endinvestments of $436.5$254 million by maintaining a disciplined capital allocation strategy, which in 2023 focused on (i) continuing to drive revenue growth by increasing adoption of DAXXIFY and a cash runway into 2024.the RHA® Collection of dermal fillers; (ii) initiating CD PrevU and pre-launch activities; and (iii) maximizing supply chain efficiencies by leveraging and scaling commercial production of DAXXIFY through ABPS. In 2023, to align our operations with our capital allocation priorities, the Company made the decision to exit its Fintech Platform business.

Executive Compensation Highlights

•RevisedContinued to increase our compensation program to include performance-vesting restricted stockemphasis on equity awards (“PSAs”).We first granted PSAs tothat vest based on performance goals. In 2023, we structured 100% of our CEO in connection with his joining us in late 2019 and we changed ourCEO’s annual equity compensation program for 2020awards to include PSAs for allconsist of PSUs and 67%-75% of our other NEOs, with vesting linkedNEOs’ annual equity awards to targeted business milestones andconsist of PSUs (based on target grant date value).

•Refined our performance goals for performance-vesting equity awards. Our 2022 PSUs vest based on a combination of a meaningful stock price appreciation goals.goal and a key regulatory goal. In 2021,2023, we increased the portion of equityrefined our 2023 PSUs to vest based on revenue goals over a three-year performance period. For 2024, PSUs vest based on rigorous TSR performance hurdles over a four-year performance period.

•Decreased CEO’s 2020 total direct compensation (base salary, annual bonus earned and equity granted) nearly 70% from 2019 levels, which had reflected one-time new hire compensation.We made no increase to our CEO’s base salary or target bonus opportunity and granted our CEO an equity award with a grant date value that is approximately 74% less than the grant date value ofhis 2019 equity compensation;

•Adopted meaningful stock ownership guidelines for executive officersIncluded people and non-employee directors;

•Structured our executive bonus opportunities to be based on key corporate objectives and we exercised discretion to reduce the bonus payouts. We exceeded our corporate goals for 2023, but our Compensation Committee used its discretion to reduce the bonus payouts to a lower amount than would have been paid pursuant to the pre-established formula under the 2023 management bonus plan in order to adjust for the exit of the Fintech Platform, which exit has now been substantially completed.

•Maintained an overall cap on executive bonuses based solely on performance achievements.We paid 2020 bonuses belowequal to 200% of target based on 67.35% corporate goal achievement, which primarily reflectedbonus for 2023. For 2024, we implemented an overall bonus cap equal to 155% of the FDA COVID Delay, and, for NEOs other than our CEO, individual performance; andtarget bonus.

•Evaluated the impact of the COVID-19 pandemic on our executive compensation program and made adjustments. As a result of the FDA COVID Delay, it was impossible for us to achieve key goals in our annual bonus program and a portionstructure of our PSAs that related2025 equity incentive plan in 2023. We commit to our BLA for DaxibotulinumtoxinA for Injection for the treatmentremoval of glabellar lines.We did not provide any discretionary payout for these BLA-related goals or our progress towards themevergreen provisions beginning in 2020, nor did2025 when we approveadopt a new goals with lower thresholds for payout. Instead, we are offering our NEOs an extended period of time to achieve these goals and, in the case of our PSAs, with additional performance requirements necessary for achievement.equity incentive plan.

Governance and Environmental, Social,ESG Highlights

•Conducted an evaluation in 2022 and 2023 of declassifying the Board and removing the supermajority voting requirements by amending the Company’s Charter and Bylaws, which the Board has committed to reevaluate on an annual basis through the Nominating and Corporate Governance ("ESG"Committee.

•Completed first third-party data governance and privacy assessments in 2023, which led to the establishment of the Company’s data governance program in March 2024.

•Furthered our Board's risk oversight function by expanding the involvement of the Audit Committee in cybersecurity risk management in 2023, including through the establishment of quarterly cybersecurity updates and an annual Audit Committee meeting dedicated to cybersecurity. Continued to conduct regular risk assessments of the Company’s executive compensation program, policies and practices.

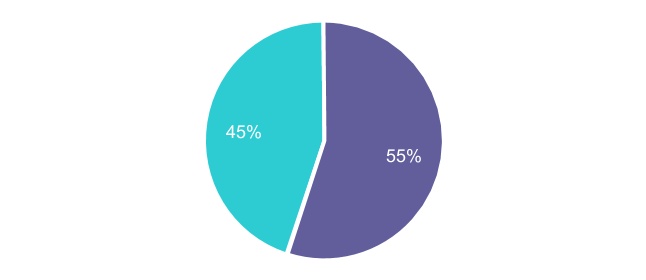

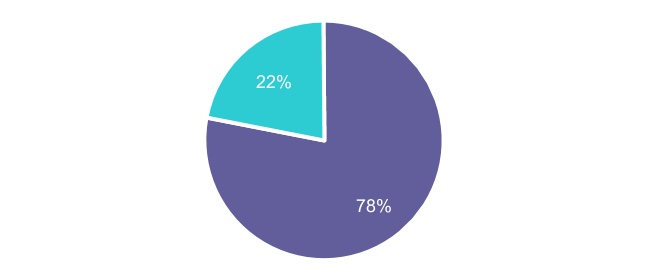

•Continued to engage in robust stockholder engagement in connection with executive compensation and ESG initiatives, and during the year ended December 31, 2023, we reached out to holders of approximately 72% of

our outstanding common stock, excluding shares held by directors and executive officers, and, from November 2023 to January 2024, held discussions with 30%.

•Completed first ESG materiality assessment in 2022 and developed second ESG report, which was published in 2023 and included expanded disclosures on key corporate governance and ESG topics.

•Formed the Revance Inclusion, Support & Empowerment (“RISE”) Highlightsnetwork of employee resource groups in 2023 that aim to enhance diversity, inclusion and belonging at the Company.

•Independent,Maintained independent, non-executive Chairman led Board of Directorsleadership of the Company (the "Board");Board.

•Actively recruitedCommitted to Board independence with seven of eight independent directors, with a 100% independent Audit Committee, Compensation Committee, Nominating and added five new directors toCorporate Governance Committee and Brand Strategy Committee.

•Continued our policy of conducting annual Board since 2019;

•ContinuedActively recruited and added six new directors to our Board since 2019, including Dr. Vlad Coric in 2023, which reflects the continued evolution of our Board such that it is comprised of diverse and highly skilled directors that provide a range of viewpoints;viewpoints.

•Increased Board diversity,Maintained a director overboarding policy in our Corporate Governance Guidelines, which all of our directors are in compliance with fouras of the nine continuing directors identifying as diverse;date hereof.

•Engaged Board attended 100% of Board and committee meetingsMaintained a 12-year director tenure policy, which is included in 2020;

Information About Our Directors

The Board currently consists of 11eight directors. Robert Byrnes, the Chair of the Compensation Committee, and Dr. Phyllis Gardner are retiring from the Board effective immediately prior to the Annual Meeting in connection with the director tenure policy adopted by the Board in 2020. As of the date of the Annual Meeting, the Board size will be nine directors. The Nominating and Corporate Governance Committee oversaw a search process to identify two new directors in connection with the anticipated retirement of Mr. Byrnes and Dr. Gardner. In connection with that process, following a recommendation from the Nominating and Corporate Governance Committee, the Board appointed Olivia C. Ware, effective March 6, 2021, and Carey O'Connor Kolaja, effective March 1, 2021. Ms. Ware was appointed as a Class I director to serve until the Annual Meeting, and Ms. Kolaja was elected as a Class III director to serve until the 2023 Annual Meeting of Stockholders.

The Board has re-nominated Angus C. Russell, Chairman of the Board, and Julian S. Gangolli and nominated Ms.Olivia C. Ware to serve until the 20242027 Annual Meeting of Stockholders or until his or her successor has been duly elected and qualified or until such director’s earlier resignation, retirement or death.

| 2021 Director Nominees | ||||||||||||||||||||

| Name | Age | Director Since | Independent | Current Committee Memberships* | Primary Occupations | Other Public Company Boards | ||||||||||||||

| Angus C. Russell | 65 | 2014 | Yes | •Compensation Committee •Nominating and Corporate Governance Committee | •Former Chief Executive Officer of Shire plc | •Mallinckrodt plc. •Lineage Cell Therapeutics, Inc. •TherapeuticsMD Inc. | ||||||||||||||

| Julian S. Gangolli | 63 | 2016 | Yes | •Audit Committee •Brand Strategy Committee | •Former President, North America of GW Pharmaceuticals Inc. | •Krystal Biotech, Inc. •Outlook Therapeutics, Inc. | ||||||||||||||

| Olivia C. Ware | 64 | 2021 | Yes | —— | •Former Senior Vice President, BTK Franchise Head of Principia Biopharma Inc. | —— | ||||||||||||||

| Continuing Directors | ||||||||||||||||||||

| Name | Age | Director Since | Independent | Current Committee Memberships* | Primary Occupations | Other Public Company Boards | ||||||||||||||

| Mark J. Foley | 54 | 2017 | No | —— | •President and Chief Executive Officer ("CEO") of Revance Therapeutics, Inc. | •Glaukos Corporation •SI-BONE, Inc. | ||||||||||||||

| Chris Nolet | 64 | 2019 | Yes | •Audit Committee | •Former Partner, Ernst & Young LLP | •PolarityTE, Inc. | ||||||||||||||

| Philip J. Vickers | 60 | 2015 | Yes | •Science and Technology Committee | •President and Chief Executive Officer of Faze Medicines | •AVROBIO, Inc. | ||||||||||||||

| Jill Beraud | 60 | 2019 | Yes | •Brand Strategy Committee | •Former Chief Executive Officer of Sh'nnong Beverage Company | •Levi Strauss & Co. | ||||||||||||||

| Carey O'Connor Kolaja | 48 | 2021 | Yes | —— | •Chief Executive Officer of AU10TIX | —— | ||||||||||||||

| Aubrey Rankin | 45 | 2020 | No | —— | •President, Innovation & Technology of the Company | —— | ||||||||||||||

| 2024 Director Nominees | ||||||||||||||||||||

| Name | Age | Director Since | Independent | Committee Memberships | Primary Occupations | Other Public Company Boards | ||||||||||||||

| Angus C. Russell | 68 | 2014 | Yes | •Compensation Committee •Nominating and Corporate Governance Committee | •Former Chief Executive Officer of Shire plc | •Lineage Cell Therapeutics, Inc. | ||||||||||||||

| Julian S. Gangolli | 66 | 2016 | Yes | •Audit Committee •Brand Strategy Committee | •Former President, North America of GW Pharmaceuticals Inc. | •Krystal Biotech, Inc. •Outlook Therapeutics, Inc. | ||||||||||||||

| Olivia C. Ware | 67 | 2021 | Yes | •Nominating and Corporate Governance Committee | •Former Senior Vice President, BTK Franchise Head of Principia Biopharma Inc. | •Arcellx, Inc. | ||||||||||||||

| Continuing Directors | ||||||||||||||||||||

| Name | Age | Director Since | Independent | Committee Memberships | Primary Occupations | Other Public Company Boards | ||||||||||||||

| Mark J. Foley | 58 | 2017 | No | —— | •Chief Executive Officer (“CEO”) of Revance | •Glaukos Corporation | ||||||||||||||

| Christian W. Nolet | 67 | 2019 | Yes | •Audit Committee •Nominating and Corporate Governance Committee | •Former Partner, Ernst & Young LLP | •Jasper Therapeutics, Inc. •ArriVent BioPharma, Inc. | ||||||||||||||

| Jill Beraud | 63 | 2019 | Yes | •Brand Strategy Committee •Compensation Committee | •Former Chief Executive Officer of Sh'nnong Beverage Company | •Levi Strauss & Co. | ||||||||||||||

| Carey O'Connor Kolaja | 51 | 2021 | Yes | •Audit Committee •Brand Strategy Committee | •Chief Executive Officer of Versapay | —— | ||||||||||||||

| Vlad Coric, M.D. | 53 | 2023 | Yes | •Compensation Committee | •Chief Executive Officer and Chairman of Biohaven, Ltd. | •Biohaven, Ltd. | ||||||||||||||

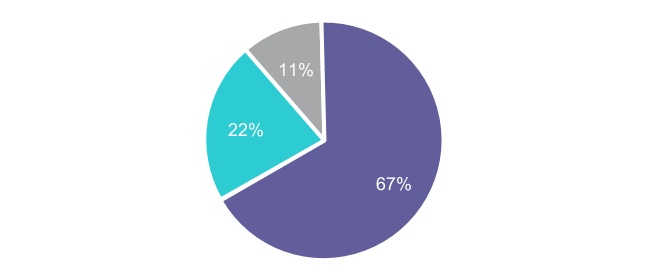

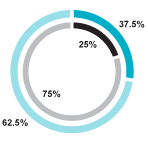

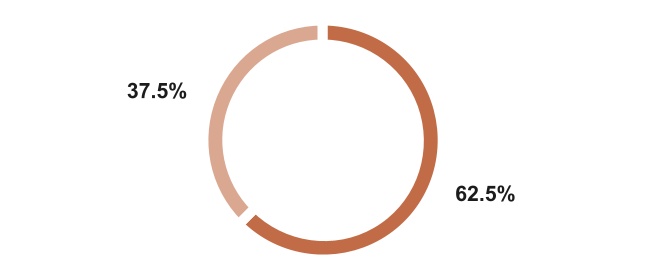

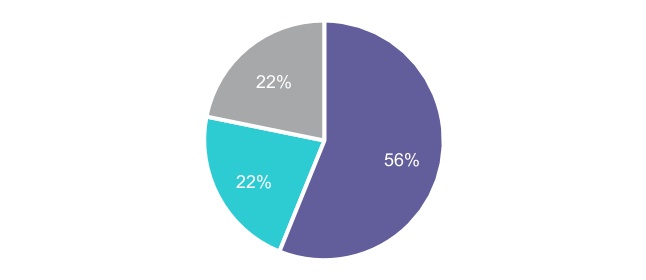

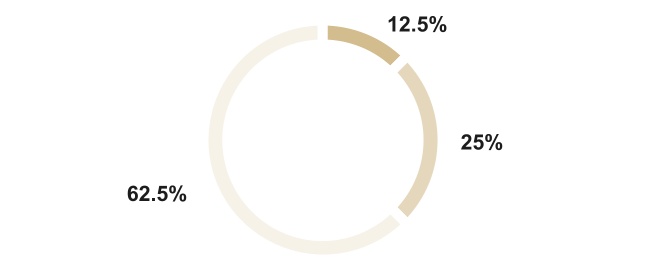

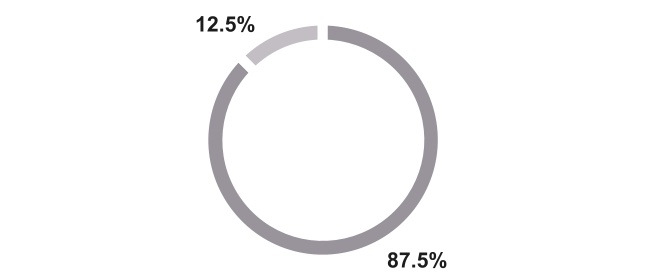

| Director Backgrounds, Experience and Diversity | |||||||||||||||||

| Diversity | Age | ||||||||||||||||

|  | ||||||||||||||||

• •Identify as Ethnically Diverse - 2 Directors | •60s - 5 Directors •50s - | |||||||||||||||||||||||||

| Tenure | Independence | |||||||||||||||||||||||||

• | •2-5 years - 2 Directors •5+ years - | •Independent - 7 Directors •Not Independent - 1 Director | ||||||||||||||||||||||||

| Board Diversity Matrix (as of March 21, 2024) | ||||||||||||||

| Total number of Directors | 8 | |||||||||||||

| Part I: Gender Identity | Male | Female | Non-Binary | Did Not Disclose | ||||||||||

| Directors | 4 | 3 | – | 1 | ||||||||||

| Part II: Demographic Background Identified | ||||||||||||||

| African American or Black | – | 1 | – | – | ||||||||||

| Alaskan Native or American Indian | – | – | – | – | ||||||||||

| Asian | – | – | – | – | ||||||||||

| Hispanic or Latinx | – | – | – | – | ||||||||||

| Native Hawaiian or Pacific Islander | – | – | – | – | ||||||||||

| White | 3 | 2 | – | – | ||||||||||

| Two or More Races or Ethnicities | 1 | – | – | – | ||||||||||

| LGBTQ+ | – | – | – | – | ||||||||||

| Did Not Disclose Demographic Background | – | – | – | 1 | ||||||||||

| Director Skills Matrix | |||||

| Senior Leadership Experience – serving or has served in a senior leadership role at another organization, including oversight of management’s development and implementation of strategic priorities | ||||

| Financial and Accounting – knowledge of the financial markets, corporate finance, accounting regulations, and accounting and financial reporting processes | ||||

| Biotechnology/Life Science – experience in or with the biotechnology, life sciences and/or pharmaceutical industries, including experience in the clinical development of pharmaceutical products | ||||

| Commercialization – experience executing corporate commercial and/or marketing strategies and initiatives | ||||

| Aesthetics Experience – experience within the medical aesthetics or beauty industry | ||||

| Information Technology/Cybersecurity Experience– experience overseeing cybersecurity, privacy, and information security management, including experience with cybersecurity strategy and policies and understanding of risk-based threat management strategies | ||||

| Risk Oversight and Risk Management – experience with and oversight over enterprise risk management | ||||

| Manufacturing and Supply Chain – experience overseeing manufacturing operations or experience in supply chain management with respect to pharmaceutical products | ||||

| Governance/Public Company Board Experience – experience serving on the boards of other public companies and knowledge regarding public company governance and compensation, policies and practices | ||||

| Human Capital Management – leadership in the maintenance and expansion of health, safety and wellness programs; training and development; compensation and benefits; and/or workforce diversity, equity and inclusion | ||||

| Therapeutics Experience – executive experience in the therapeutics industry, including expertise in the research and development of therapeutic products in the fields of neuroscience and muscle movement disorders, relevant to our business and strategy | ||||

| International Experience— experience conducting business or operations outside of the United States, including an understanding of political, regulatory, economic and cultural frameworks valuable to understanding opportunities and risks entering global markets | ||||

|  |  |  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||

| A. Russell | l | l | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||

| J. Gangolli | l | l | l | l | l | l | l | l | l | l | l | |||||||||||||||||||||||||||

| O. Ware | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||||

| M. Foley | l | l | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||

| C. Nolet | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||||

| J. Beraud | l | l | l | l | l | l | l | |||||||||||||||||||||||||||||||

| C. Kolaja | l | l | l | l | l | l | l | |||||||||||||||||||||||||||||||

| V. Coric | l | l | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||

We believe our directors have an appropriate balance of knowledge, experience, attributes, skills, diversity and expertise as a group to ensure that the Board appropriately fulfills its oversight responsibilities and acts in the best interests of stockholders. Although specific qualifications for Board membership may vary from time to time, desired qualities include (A)(i) the highest personal integrity and ethics, (B)(ii) relevant expertise upon which to be able to offer advice and guidance to management, (C)(iii) demonstrated excellence in his or her field, (D)(iv) sound business judgment, and (E)(v) sufficient time to devote to the affairs of the Company, and (F)(vi) commitment to rigorously represent the long-term interests of our stockholders. The following charts show the key skills and experienceexperiences that we consider important in light offor our current business structure and that our directors bringBoard to our boardroom:

possess.

TABLE OF CONTENTS

| Page | |||||

QUESTIONS AND ANSWERS

ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the Internet?

We sent you the proxy notice because our Board is soliciting your proxy to vote at our Annual Meeting, including at any adjournments or postponements of the meeting. We have elected to provide access to the full proxy materials over the Internet and have provided our stockholders with instructions on how to access the proxy materials in the Notice of Internet Availability of Proxy Materials (the “Notice”) that you received.

Rules adopted by the Securities and Exchange Commission (the “SEC”) allow us to provide access to our proxy materials over the Internet. All stockholders will have the ability to access the proxy materials on the website at www.proxyvote.com, or may request a printed set of the proxy materials. Instructions on how to access the proxy materials or to request a printed copy may be found in the Notice.

We intend to mail the Notice to all stockholders of record entitled to vote at the Annual Meeting on or about March 24, 2021.21, 2024.

How do I attend the Annual Meeting?

This year’s Annual Meeting will be held entirely online due to the public health concerns regarding the COVID-19 pandemic.online. You will not be able to attend the Annual Meeting in person. The meeting will be held virtually on May 5, 20211, 2024 at 10:00 a.m. Central Time via live audio-only webcast at www.virtualshareholdermeeting.com/RVNC2021.RVNC2024. To attend the meeting, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Online check-in will begin at 9:45 a.m. Central Time, and you should allow ample time for the check-in procedures.

The virtual meeting has been designed to provide the same rights to participate as you would have at an in-person meeting. Information on how to vote by Internet before and during the Annual Meeting is discussed below.

How do I ask questions at the virtual Annual Meeting?

During the Annual Meeting, you may submit questions in the question box provided at www.virtualshareholdermeeting.com/RVNC2021.RVNC2024. We will respond to as many inquiries at the Annual Meeting as time allows.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual Annual Meeting audio-only webcast during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting website log-in page.

What if I cannot virtually attend the Annual Meeting?

You may vote your shares electronically before the meeting by Internet, by proxy or by telephone as described below. You do not need to access the Annual Meeting audio-only webcast to vote if you submitted your vote via proxy, by Internet or by telephone in advance of the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 11, 20218, 2024 will be entitled to vote at the Annual Meeting. On thisthe record date, there were 71,382,894104,215,614 shares of common stock outstanding and entitled to vote.

1

Stockholder of Record: Shares Registered in Your Name

If on March 11, 20218, 2024 your shares were registered directly in your name with our transfer agent, Computershare, then you are a stockholder of record. As a stockholder of record, you may vote by Internet before or during the Annual meeting,Meeting, by telephone or by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the proxy card or vote by Internet or by telephone before the meeting to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 11, 20218, 2024 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. You may vote your shares by Internet during the meeting with the 16-digit control number included in the Notice, proxy card or in the other materials provided by your bank, brokerage firm or other nominee.

What am I voting on?

There are fourthree matters scheduled for a vote:

•Election of directors;

•Ratification of the selection of PwC as the independent registered public accounting firm for the fiscal year 2021;2024; and

•Approval of, on an advisory basis, the compensation of our named executive officers; and

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, the persons designated in the accompanying proxy intend to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” or “Withhold” for each of the nominees to the Board.

For the proposal to ratify the selection of PwC, and to approve, on an advisory basis, the compensation of our named executive officers, and to approve the amendment to our Charter, you may vote “For,” “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote by Internet before or during the Annual Meeting, by telephone before the Annual Meeting or by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted.

•To vote using the proxy card, simply complete, sign, date and return the proxy card pursuant to the instructions on the card. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct us to.

•To vote over the telephone before the Annual Meeting, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompanied

your proxy materials. Your telephone vote must be received by 11:59 p.m. Eastern Time on May 4, 2021April 30, 2024 to be counted.

•To vote through the Internet before the Annual Meeting, go to www.proxyvote.com and follow the on-screen instructions. You will need the 16-digit control number included in your Notice, on your proxy card

2

or on the instructions that accompanied your proxy materials. Your Internet vote must be received by 11:59 p.m., Eastern Time on May 4, 2021April 30, 2024 to be counted.

•To vote through the Internet during the meeting, please visit www.virtualshareholdermeeting.com/RVNC2021RVNC2024 and have available the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker or other agent, you should have received a notice containing voting instructions from that organization rather than from Revance. Simply follow the voting instructions in the notice to ensure that your vote is counted. You may vote your shares by Internet during the meeting with the 16-digit control number included in the Notice, proxy card or in the other materials provided by your bank, brokerage firm or other nominee.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 11, 2021.8, 2024.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone before the Annual Meeting, or through the Internet before or during the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Other Agent

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. In this regard, under the rules of the New York Stock Exchange ("NYSE"(“NYSE”), brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. Under the rules and interpretations of NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Therefore, without your instructions, your broker or other agent may not vote your shares on Proposal 1 (election (Election of directors)Directors), or Proposal 3 (advisory vote (Advisory Vote on executive compensation)Executive Compensation) which are considered to be "non-routine"“non-routine” matters, but may vote your shares on Proposal 2 (ratification (Ratification of auditors) and Proposal 4 (amendment to our Charter to increase the authorized shares of our common stock)Auditors), which areis considered to be "routine" matters.a “routine” matter.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all nominees for director, “For” the ratification of the selection of PwC as the independent registered public accounting firm for the fiscal year 2021,2024, and “For” the compensation of our named executive officers and "For" the amendment to our Charter to increase the authorized shares of our common stock.officers. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. We have engaged Alliance Advisors as our proxy solicitor to help us solicit proxies for a fee of $22,500, plus reasonable out-of-pocket expense. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokers and other agents for the cost of forwarding proxy materials to beneficial owners.

3

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each of the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the Internet. You will need the 16- digit control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

•You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 7555 Gateway Blvd., Newark, CA 94560.1222 Demonbreun Street, Suite 2000, Nashville, Tennessee, 37203.

•You may virtually attend the Annual Meeting and vote by Internet by visiting www.virtualshareholdermeeting.com/RVNC2021RVNC2024. To attend the meeting, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Simply attending the meeting will not, by itself, revoke your proxy.

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Agent

If your shares are held by your broker or agent, you should follow the instructions provided by your broker or agent.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by November 24, 2021,21, 2024, to Secretary, Revance Therapeutics, Inc., 7555 Gateway Blvd., Newark, CA 94560.1222 Demonbreun Street, Suite 2000, Nashville, Tennessee, 37203. If you wish to submit a proposal (including a director nomination) at the meeting that is not to be included in next year’s proxy materials, you must do so no earlier than the close of business on January 5, 2022,1, 2025, and no later than the close of business on February 4, 2022.January 31, 2025. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. In addition, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must also comply with the additional requirements of Rule 14a-19(b).

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count:

•votes “For,” “Withhold” and broker non-votes for the proposal to elect directors (Proposal 1)(Proposal 1); and

•votes “For,” and “Against,” abstentions and, if applicable, broker non-votes for the ratification of the auditors (Proposal 2)(Proposal 2), and for the advisory vote on executive compensation (Proposal 3) and for the proposal to amend the Charter to increase the number(Proposal 3).

4 (Charter amendment), abstentions (and broker non-votes, if any) will be counted towards the vote total and will have the same effect as “Against” votes.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under NYSE rules, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.”

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

How many votes are needed to approve each proposal?

Assuming that a quorum is present at the annual meeting, the following votes will be required for approval:

| Proposal | Vote Required for Approval | |||||||

| Proposal 1 | Directors shall be elected by a plurality of the votes of the shares present in person, by remote communication, or represented by proxy at the meeting and entitled to vote generally on the election of directors. | |||||||

| Proposal 2 | Affirmative vote of the majority of shares present in person, by remote communication or represented by proxy at the meeting and entitled to vote generally on the subject matter. | |||||||

| Proposal 3 | Affirmative vote of the majority of shares present in person, by remote communication or represented by proxy at the meeting and entitled to vote generally on the subject matter. | |||||||

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding a majority of the outstanding shares entitled to vote are present at the meeting in person, by remote communication or represented by proxy. On the record date of March 11, 2021,8, 2024, there were 71,382,894104,215,614 shares outstanding and entitled to vote. Thus, the holders of 35,691,44852,107,808 shares must be present in person, by remote communication or represented by proxy at the meeting to have a quorum.

Your shares will be counted toward the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker or other agent), vote over the telephone before the Annual Meeting, vote through the Internet before the Annual Meeting, or if you virtually attend the Annual Meeting and vote by Internet during the Annual Meeting by visiting www.virtualshareholdermeeting.com/RVNC2021RVNC2024. Abstentions and broker non-votes will be counted toward the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person, by remote communication or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

5

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board is divided into three classes, with each class having a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board currently consists of 11 directors. Mr. Byrnes, the Chair of the Compensation Committee, and Dr. Gardner are retiring from the Board effective immediately prior to the Annual Meeting in connection with the director tenure policy adopted by the Board in 2020. As of the date of the Annual Meeting, the Board size will be nineeight directors. There are three directors in the class whose term of office expires in 2021,2024, Mr. Russell, Mr. Gangolli and Ms. Ware, and each of these directors areis standing for re-election at the Annual Meeting. Each of Mr. Russell, Mr. Gangolli and Ms. Ware is currently a director of the Company and was nominated by the Nominating and Corporate Governance Committee. Of the three nominees, eachEach of Mr. Russell, and Mr. Gangolli hasand Ms. Ware have previously been elected by the stockholders, while Ms. Ware was appointed by the Board in March 2020.stockholders. If elected at the Annual Meeting, each of these nominees agreed to serve until the 20242027 annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until their death, resignation or removal. It is our policy to encourage directors and nominees for director to attend the Annual Meeting. All of the directors who were members of our Board at the time of the 20202023 Annual Meeting of Stockholders attended the 20202023 Annual Meeting.Meeting of Stockholders. See the “Proxy Summary—Information About Our Directors—Director Backgrounds, Experience and Diversity” for information on director background and diversity.

Our Board has established a director tenure policy, which provides that directors reaching 12 years of service will be evaluated by the full Board with the expectation of stepping down. In certain circumstances, a majority vote of the independent directors can be used to extend the service of a 12-year term director. If a 12-year director’s term is extended, they will be evaluated annually with the expectation that they will step down unless a majority vote of independent directors determines to extend their service for another year. The Board has re-nominated Mr. Russell for a three-year term with the expectation that he step down when he reaches 12 years of service in 2026, consistent with this policy. The Board will evaluate at that time whether to extend his service.

Required Vote and Board Recommendation

Directors are elected by a plurality of the votes of the shares present in person, by remote communication, or represented by proxy at the meeting and entitled to vote generally on the election of directors. The three director nominees receiving the highest number of “For” votes will be elected. In tabulating the voting results for the election of directors, withhold votes and broker non-votes have no effect and will not be counted towards the number of shares voted “For”.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OFFOR EACH NAMED NOMINEE.

6

DIRECTORS

The following is a brief biography of each director nominee and each of our other continuing directors, including their respective ages as of the date of this proxy statement.Proxy Statement. Each biography includes information regarding the experience, qualifications, attributes or skills that caused our Board to determine that each applicable nominee or other current director should serve as a member of our Board. The categories of key skills are:

|  |  |  | ||||||||||||||||

| Senior Leadership Experience | Financial and Accounting | Biotechnology/Life Science | Commercialization | ||||||||||||||||

|  |  |  | ||||||||||||||||

| Information Technology/Cybersecurity Experience | |||||||||||||||||||

| Risk Oversight and Risk Management | Manufacturing and Supply Chain | |||||||||||||

|  |  |  | |||||||||||

| Governance/Public Company Board Experience | Human Capital Management | Therapeutics Experience | International Experience | |||||||||||

| Name | Age | Title | Class and Year Term Ending | ||||||||

| Angus C. Russell | Chairman of the Board | Class I (Term Ending | |||||||||

| Julian S. Gangolli | Director | Class I (Term Ending | |||||||||

| Olivia C. Ware | Director | Class I (Term Ending | |||||||||

| Mark J. Foley | Class II (Term Ending | ||||||||||

| Director | Class II (Term Ending | ||||||||||

| Director | |||||||||||

| Class III (Term Ending | |||||||||||

| Carey O'Connor Kolaja | Director | Class III (Term Ending | |||||||||

| Class III (Term Ending | |||||||||||

1Our Board has established a director tenure policy, which provides that directors reaching 12 years of service will be evaluated by the full Board with the expectation of stepping down. In certain circumstances, a majority vote of the independent directors, can be used to extend the service of a 12-year term director. If a 12-year director’s term is extended, he/she will be evaluated annually with the expectation that he/she will step down unless a majority vote of independent directors determines to extend his/her term for another year. The Board has re-nominated Mr. Russell for a three-year term with the expectation that he step down when he reaches 12 years of service in 2026, consistent with this policy. The Board will evaluate at that time whether to extend his service.

7

| Angus C. Russell | ||||||||||||||||||||||||||||||||||||||

| His experience at Shire plc and other public pharmaceutical companies provide invaluable insights that will support the  | |||||||||||||||||||||||||||||||||||||

Committee Memberships Compensation Committee (member since February 2018) Nominating and Corporate Governance Committee | ||||||||||||||||||||||||||||||||||||||

Positions Shire plc •CEO (2008 – 2013) •CFO (1999 – 2008) AstraZeneca •VP, Corporate Finance (1999) | Current Public Company Directorships Lineage Cell Therapeutics, a clinical stage biotechnology company (December 2014 – present) Other Public Company Board Experience Mallinckrodt plc, a commercial-stage pharmaceutical company (August 2014 to June 2022) TherapeuticsMD, a commercial-stage pharmaceutical company (March 2015 to December 2022) | |||||||||||||||||||||||||||||||||||||

| Key Skills | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||||

8

| Julian S. Gangolli | ||||||||||||||||||||||||||||||||||||||

| Mr. Gangolli’s experience navigating complex commercial operations at global, public pharmaceutical companies, including his experience in launching new products and strategic licensing deals, provides valuable insight to the Board and the Company as it aims to build its aesthetic and therapeutic franchises through the recent launch of DAXXIFY. Mr. Gangolli also provides the Board with valuable perspectives and background given the breadth of his experience serving on other public company boards. | |||||||||||||||||||||||||||||||||||||

Independent Director since 2016 Committee Memberships Audit Committee (member since July 2016) Brand Strategy Committee (member since October 2019) | ||||||||||||||||||||||||||||||||||||||

Positions GW Pharmaceuticals Inc. •President, North America (2015 – 2019) Allergan Inc. •President, •Senior Vice President, U.S. Eye Care Other Roles at VIVUS, Inc., Syntex Pharmaceuticals, Inc. | Current Public Company Directorships Krystal Biotech, Outlook Therapeutics, Other Public Company Board Experience GW Pharmaceuticals, a commercial-stage biopharmaceutical  | |||||||||||||||||||||||||||||||||||||

| Key Skills | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||||||

| Olivia C. Ware | ||||||||||||||||||||||||||||||||||||||

| Ms. Ware’s experience provides the Board with critical insights as the Company continues to make investments in its portfolio of products in order to deliver on its strategy of building valuable aesthetic and therapeutic franchises and growing its market share. The Board values Ms. Ware’s background in successfully launching a variety of therapeutic products as  | |||||||||||||||||||||||||||||||||||||

Committee Memberships Nominating and Corporate Governance Committee (member since May 2021) | ||||||||||||||||||||||||||||||||||||||

Positions •Senior Vice President, BTK Franchise (November 2019 – March 2021) Proetus Digital Health, Inc. •Senior Vice President (August 2018 – November 2019) Genentech, Inc. •Head, Team Leadership Group (March 2007 – January 2010) •Senior Director, Avastin Marketing (June 2003 – March 2007) •Director, Herceptin Marketing (February 2001 – June 2003) •Senior Product Manager, Rituxan Marketing (February 1999 – January 2001) | Current Public Company Directorships Arcellx, Inc., a clinical-stage biotechnology company (May 2022 – present) Other Public Company Board Experience Ambrx Biopharma Inc., a clinical-stage biopharmaceutical company (April 2021 – June 2022) | |||||||||||||||||||||||||||||||||||||

| Key Skills | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  | |||||||||||||||||||||||||||||||

10

| Mark J. Foley | ||||||||||||||||||||||||||||||||||||||

| We believe Mr. Foley  | |||||||||||||||||||||||||||||||||||||

| Non- Independent Director since 2019 Independent Director 2017 - 2019 | ||||||||||||||||||||||||||||||||||||||

Positions Revance Therapeutics, Inc. •Chief Executive Officer (October 2019 – present) ZELTIQ Aesthetics •Chairman, President and CEO •Managing Member (2004 – 2018) Ventrica, Inc. •Founder, CEO (1998 – 2004) | Current Public Company Directorships Glaukos Corporation, a commercial-stage medical technology and pharmaceutical company (2015 – present) Other Public Company Board Experience SI-BONE, Inc., a commercial-stage medical device company (2019 – 2021) | |||||||||||||||||||||||||||||||||||||

| Key Skills | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||||

| Christian W. Nolet | ||||||||||||||||||||||||||||||||||||||

| Mr. Nolet’s  | |||||||||||||||||||||||||||||||||||||

Committee Memberships Audit Committee Nominating and Corporate Governance Committee Education & Certifications B.S. in Accounting, San Diego State University Certified Public Accountant, retired (California) | ||||||||||||||||||||||||||||||||||||||

Positions Ernst & Young LLP (EY) •Partner and West Region Life Sciences Industry Leader (2001 – 2019) PricewaterhouseCoopers LLP •Partner (1991 – 2001) Other Experience California Life Sciences, a life science advocacy organization – Executive Committee and Finance Committee (Treasurer) Biotechnology Innovation Organization, a biotech trade association – Finance & Investment Committee, Emerging Companies Section | Current Public Company Directorships Jasper Therapeutics, a clinical-stage biotechnology company (August 2021 – present) ArriVent Biopharma, a clinical-stage biopharmaceutical company (September 2023 - present) Other Public Company Board Experience Viela Bio, Inc., a commercial-stage biotechnology company (August 2019 – March 2021) PolarityTE, a clinical-stage biotechnology company (March 2020 – January 2023) Ambrx Biopharma Inc., a clinical-stage biopharmaceutical company (January 2021 – November 2021) | |||||||||||||||||||||||||||||||||||||

| Key Skills | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  | |||||||||||||||||||||||||||||||

12

| Jill Beraud | ||||||||||||||||||||||||||||||||||||||

|  | |||||||||||||||||||||||||||||||||||||

| Throughout Ms. Beraud’s career she has driven company performance through improving brand recognition and through her leadership of consumer marketing initiatives. As the Company begins to establish its strategy for growing its aesthetics franchise and growing the Revance brand with health care | |||||||||||||||||||||||||||||||||||||

Independent Director since 2019 Committee Memberships Brand Strategy Committee - Chair (member since October Compensation Committee - Chair (member since May 2021) | ||||||||||||||||||||||||||||||||||||||

Positions Sh’nnong Beverage Company •CEO and Co-Founder (2018 – 2021) IPPOLITA •CEO (2015 – 2018) Tiffany & Company •EVP, Global Retail & E-commerce (2014 – 2015) Living Proof, Inc. •CEO (2011 – 2014) PepsiCo •President, •Global Chief Marketing Officer Limited Brands •Victoria’s Secret, EVP/Chief Marketing Officer •EVP/COO Marketing (2005 – 2007) •EVP Marketing, Victoria’s Secret Current Public Company Directorships Levi Strauss & Co.  | ||||||||||||||||||||||||||||||||||||||

| Key Skills | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  | ||||||||||||||||||||||||||||||||

| Carey O’Connor Kolaja | ||||||||||||||||||||||||||||||||||||||

| Ms. Kolaja Ms. Kolaja’s | |||||||||||||||||||||||||||||||||||||

Independent Director since 2021  Committee Memberships Audit Committee (member since May 2023) Brand Strategy Committee (member since May 2021) | ||||||||||||||||||||||||||||||||||||||

Positions Versapay •CEO and Board Member (March 2023 – present) AU10TIX •CEO (October 2020 – October 2022) •President and COO (May 2019 – October 2020) Citi Fintech, Citigroup Inc. •Global Chief Product Officer (November 2015 – April 2019) PayPal Holdings, Inc. •Various Positions (2003 – 2015) Other Board Experience NEOLOGY INC., a global technology company (March 2019 – March 2023) | ||||||||||||||||||||||||||||||||||||||

| Key Skills | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  | ||||||||||||||||||||||||||||||||

14

| Vlad Coric, M.D. | ||||||||||||||||||||||||||||||||||||||

| Dr. Coric’s experience in discovering, developing and commercializing therapies that address unmet medical needs enables him to provide the Board with invaluable guidance as the | |||||||||||||||||||||||||||||||||||||

Independent Director  Compensation Committee (member since May 2023) | ||||||||||||||||||||||||||||||||||||||

Positions Biohaven Limited (formerly Biohaven Pharmaceutical Holding Company Limited) •CEO and Chairman, Board of Directors (October 2015 – present) Yale School of Medicine •Associate Clinical Professor (December 2006 – present) •Assistant Clinical Professor (July 2001 – December 2006) Bristol-Myers Squibb •Group Director, Global Clinical Research (January 2007 – September 2015) | Current Public Company Directorships Biohaven Limited, a clinical-stage biopharmaceutical company (2015 - present) Other Board Experience Veradermics, a clinical-stage medical dermatology company Vita Therapeutics, a clinical-stage biotechnology company Pyramid Biosciences, a clinical-stage oncology company | |||||||||||||||||||||||||||||||||||||

| Key Skills | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||||

BOARD MATTERS

Independence of the Board

As required under Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors.directors on at least an annual basis. The Board consults with the Company's counsellegal department to ensure that the Board's determinations are consistent with relevant securities and other laws and regulations regarding the definition of "independent,"“independent,” including those set forth in the pertinent listing standards of Nasdaq, as in effect from time to time. Consistent with these considerations, after review of all relevant identified transactions and relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that all of our directors, including our 2024 director nominees, except for Mr. Foley, our President and CEO, and Mr. Rankin, our President of Innovation & Technology, representing seven of our nine continuing directors, are “independent directors” within the meaning of the applicable Nasdaq listing standards. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company.Company that would compromise their ability to exercise independent judgment.

Board Leadership Structure

Our Board has an independent chair (the “Board Chair”), Mr. Russell, who has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Board Chair has substantial ability to shape the work of the Board. The Company believes that separation of the positions of Board Chair and CEO reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, the Company believes that having an independent Board Chair creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and its stockholders. As a result, we believe that having an independent Board Chair can enhance the effectiveness of the Board as a whole.

Role of the Board in Risk Oversight

Areas of Board and Committee hasRisk Oversight

| Areas of Focus | Audit | Brand Strategy | Compensation | Nominating and Corporate Governance | Board | ||||||||||||

| Accounting and Financial Reporting | X | X | |||||||||||||||

| Audit Matters | X | X | |||||||||||||||

| Cybersecurity | X | X | |||||||||||||||

| Enterprise Risk Management | X | X | |||||||||||||||

| Investments & Investment Guidelines | X | X | |||||||||||||||

| Related Person Transactions | X | X | |||||||||||||||

| Customer and Consumer Reputational Risk | X | X | |||||||||||||||

16

| Areas of Focus | Audit | Brand Strategy | Compensation | Nominating and Corporate Governance | Board | ||||||||||||

| Commercialization and Marketing Risks | X | X | |||||||||||||||

| Services & Solutions Innovation | X | X | |||||||||||||||

| Incentive Plans | X | X | |||||||||||||||

| Diversity, Equity and Inclusion strategy | X | X | X | ||||||||||||||

| Executive Compensation Practices | X | X | |||||||||||||||

| Human Capital Management | X | X | |||||||||||||||

| Executive Officer Succession Planning | X | X | X | ||||||||||||||

| Corporate Governance | X | X | |||||||||||||||

| Board Evaluation | X | X | |||||||||||||||

| Board Succession Planning | X | X | |||||||||||||||

| ESG | X | X | |||||||||||||||

| Stockholder Concerns | X | X | |||||||||||||||

| Business Strategy | X | ||||||||||||||||

| Financing Strategy | X | ||||||||||||||||

Our Board oversight of risk is informed by updates from management team members responsible for oversight of particular risk areas, which typically occurs quarterly, but may occur more often as business developments dictate.

Cybersecurity and Information Security Risk

We recognize the responsibilityimportance of information security, cyber readiness, and data privacy protections to considerour business and discuss our major financial risk exposures and the steps ourreputation. While management has taken to monitor and control these exposures, including guidelinesgeneral responsibility for implementation of our information technology, cybersecurity, and policies, to governstandards and practices, including vigilance, deployment and use of system safeguards, employee training and incident response and recovery planning, the process by which risk assessmentBoard and management is undertaken. In addition, our Audit Committee hasare actively engaged in the responsibility to consider the adequacy and effectivenessoversight of our information security policies and practicesprogram. The Board’s oversight of cybersecurity risk management is supported by the Audit Committee, which regularly interacts with the company’s Chief Financial Officer (“CFO”), the Company’s VP of Information Technology, other members of management and the internal controls regardingCompany's external Chief Information Security Officer.

Board Cybersecurity Expertise

Ms. Kolaja, who is an expert in data and asset protection through the use of technology and has had key information security responsibilities on a global scale in connection with product development over the last twenty years, became a member of the Audit Committee in 2023. See “Directors” for further information on Ms. Kolaja’s cybersecurity experience.

Board and Audit Committee Oversight

The Board and the Audit Committee each receive regular presentations and reports on cybersecurity risks, which address a wide range of topics including, those concerning data privacy, cybersecurityfor example, recent developments, evolving standards, vulnerability

17

assessments, third-party and backup ofindependent reviews, the threat environment, technological trends and information systems. Oursecurity considerations arising with respect to the Company’s peers and third parties. The Audit Committee also monitors compliance with legalreceives prompt and regulatory requirements. Our Nominating and Corporate Governancetimely information regarding any cybersecurity incident that meets preestablished factors, as well as ongoing updates regarding such incident until it has been resolved. Cybersecurity events that meet specified criteria are also escalated to the Disclosure Committee. At least once each year, the Audit Committee monitorsholds a meeting dedicated to cybersecurity matters, in addition to receiving quarterly updates on cybersecurity matters at regularly scheduled Audit Committee meetings. On at least an annual basis, Company management presents to the effectiveness of our ESG strategy and corporate governance policies, including whether they are successful in preventing illegal or improper liability-creating conduct, and stockholder engagement. Our Compensation Committee reviews and approves executive officer compensation and its alignment withBoard on the Company's business and strategic plans and assesses and monitors whether anyapproach to cybersecurity risk management.

Management Oversight

The Company’s VP of our compensation policies and programs hasInformation Technology is the potential to encourage excessive risk-taking.

Incident Response and Recovery Planning

The Company has established a strategy to mitigate the immediate and potential long-term impactsCore Incident Response Team, which is comprised of the pandemic, protect the healthVP of Information Technology and members of the cybersecurity, legal and enterprise risk & commercial compliance teams. The Core Incident Response Team works with other members of the Company’s management and collaboratively across the Company to promptly respond to cybersecurity incidents in accordance with the Company’s incident response and its employeesrecovery plans. Through the ongoing communications from these teams, the Core Incident Response Team, along with the CFO, monitors the prevention, detection, mitigation and continue to executeremediation of cybersecurity incidents in real time. Cybersecurity events that meet specified criteria are escalated for further review by the Audit Committee and/or the Disclosure Committee. The Disclosure Committee assesses and determines materiality based on our strategic objectivesthe information provided by the Incident Response Team and deliver value to our stockholders. Management provided regular updatesmakes recommendations to the BoardCFO regarding disclosure. The Company also maintains cybersecurity insurance coverage to supplement our cybersecurity program given the complex and evolving nature of cyber threats.

Data Governance Committee

In 2023, the Company conducted a third-party data governance assessment. Following the completion of this assessment, in March 2024, the Company established a data governance program which is designed to ensure that the Company’s data assets are of high quality, secure, compliant and aligned with the Company’s strategic goals and values. The program is led by the Data Governance Steering Committee, which is sponsored by the CFO and Chief Legal Officer & General Counsel (“CLO”). It is comprised of the VP of Information Technology and cross-functional senior leaders from cybersecurity, legal, enterprise risk and commercial compliance, commercial and operations. The Data Governance Steering Committee will present to the Audit Committee updates on its committees regarding the progress on this strategy.project roadmap and status of key initiatives.

Meetings of the Board

The Board met seven times during 2020.2023. All directors, except Dr. Vlad Coric, attended 100% of the aggregate number of meetingsat least 75% of the Board and committee meetings of the committees on which theyhe/she served during 2020.fiscal year 2023.

Information Regarding Committees of the Board

The Board hashad an established an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee a Science and Technology Committee and a Brand Strategy Committee.Committee during the year ended December 31, 2023. The following table provides membership information for each of the Board committees as of December 31, 2020:2023 and the number of meetings held by each committee during 2023:

Name(1) | Audit | Compensation | Nominating and Corporate Governance | Science and Technology | Brand Strategy | |||||||||||||||||||||||||||

| Jill Beraud | X* | |||||||||||||||||||||||||||||||

| Robert Byrnes | X | X* | X | |||||||||||||||||||||||||||||

| Julian S. Gangolli | X | X | ||||||||||||||||||||||||||||||

| Phyllis Gardner, M.D. | X | X | ||||||||||||||||||||||||||||||

| Chris Nolet | X* | |||||||||||||||||||||||||||||||

| Angus C. Russell | X | X* | ||||||||||||||||||||||||||||||

| Philip J. Vickers, Ph.D. | X* | |||||||||||||||||||||||||||||||

| Meetings | 4 | 5 | 1 | 4 | 4 | |||||||||||||||||||||||||||

Name1 | Audit | Compensation | Nominating and Corporate Governance | Brand Strategy | ||||||||||||||||||||||

| Jill Beraud | X | X | ||||||||||||||||||||||||

| Vlad Coric, M.D. | X | |||||||||||||||||||||||||

| Julian S. Gangolli | X | X | ||||||||||||||||||||||||

| Chris Nolet | X | X | ||||||||||||||||||||||||

| Carey O'Connor Kolaja | X | X | ||||||||||||||||||||||||

| Angus C. Russell | X | X | ||||||||||||||||||||||||

| Olivia C. Ware | X | |||||||||||||||||||||||||

| Meetings | 7 | 5 | 4 | 3 | ||||||||||||||||||||||

Boxes including a bold X indicate committee chairperson.

1 Dr. Philip Vickers was a member of the Audit Committee and Nominating and Corporate Governance Committee, and Dr. Gardner, a current member of the Compensation Committee and Science and Technology Committee, are retiring from the Board effective immediately prior to the Annual Meeting in connection with the director tenure policy adopted by the Board in 2020. Effective as of the Annual Meeting, committee composition will change as follows: Ms. Beraud will become Chair of the Compensation Committee and Ms. Kolaja will become a member of the Compensation Committee; Dr. Vickers will become a member of the Audit Committee; Mr. Nolet and Ms. Ware will become members of the Nominating and Corporate Governance Committee; Ms. Ware will become a member of the Science and Technology Committee; and Ms. Kolaja will join the Brand Strategy Committee.until his retirement on May 3, 2023.

Below is a description of each standing committee of the Board.standing committees of the Board in 2023.

Audit Committee

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”), to oversee our corporate accounting and financial reporting processes and audits of itsour consolidated financial statements. The principal duties and responsibilities of our Audit Committee include:

•appointing and retaining an independent registered public accounting firm to serve as independent auditor to audit our consolidated financial statements, overseeing the independent auditor’s work and determining the independent auditor’s compensation;

•approving in advance all audit services and non-audit services to be provided to us by our independent auditor;

•establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls, auditing or compliance matters, as well as for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters;

•reviewing and discussing with management and our independent auditor the results of the annual audit and the independent auditor’s review of our quarterly condensed consolidated financial statements;

•conferring with management and our independent auditor about the scope, adequacy and effectiveness of our internal accounting controls, the objectivity of our financial reporting and our accounting policies and practices;

•establishing appropriate insurance coverage for the Company’s directors and officers;

•reviewing and discussing with management and, as appropriate, the independent auditor, the Company’s guidelines and policies with respect to risk assessment and risk management, including the Company’s major financial risk exposures and the steps taken by management to monitor and control these exposures andexposures;

•assessing the adequacy and effectiveness of the Company’s information security policies and practices and the internal controls regarding information security, including those concerning data privacy, cybersecurity, and backup of information systems;systems and compliance with PCI DSS (which will no longer be applicable following the full shut down of the Fintech Platform);

•reviewing and overseeing any material cybersecurity incidents and data breaches and the Company’s plans to mitigate cybersecurity risks; and

•reviewing and assessing, at least annually, the performance of the Audit Committee and the adequacy of its charter.

19

The Audit Committee is currently composed of three directors: Mr. Nolet, Mr. ByrnesGangolli and Mr. Gangolli,Ms. Kolaja, with Mr. Nolet serving as chair of the committee. Effective as of the Annual Meeting, Mr.Dr. Philip Vickers will becomewas a member of the Audit Committee.Committee until his retirement from the Board effective May 3, 2023. The Board has adopted a written Audit Committee charter that is available to stockholders on our website at www.revance.com.